CIO Viewpoint: Another crisis in Europe? Debt or Energy?

The Fed is not the only central bank that has sent clear tightening signals, so has the ECB. It has announced to end the PEPP (Pandemic Emergency Purchase Programme) purchases in March and will replace it with a smaller and declining sized asset purchase program. In addition, the central bank recently addressed the higher inflation concern and refused to repeat that “a rate hike is very unlikely”, which awakened an unpleasant memory in the market.

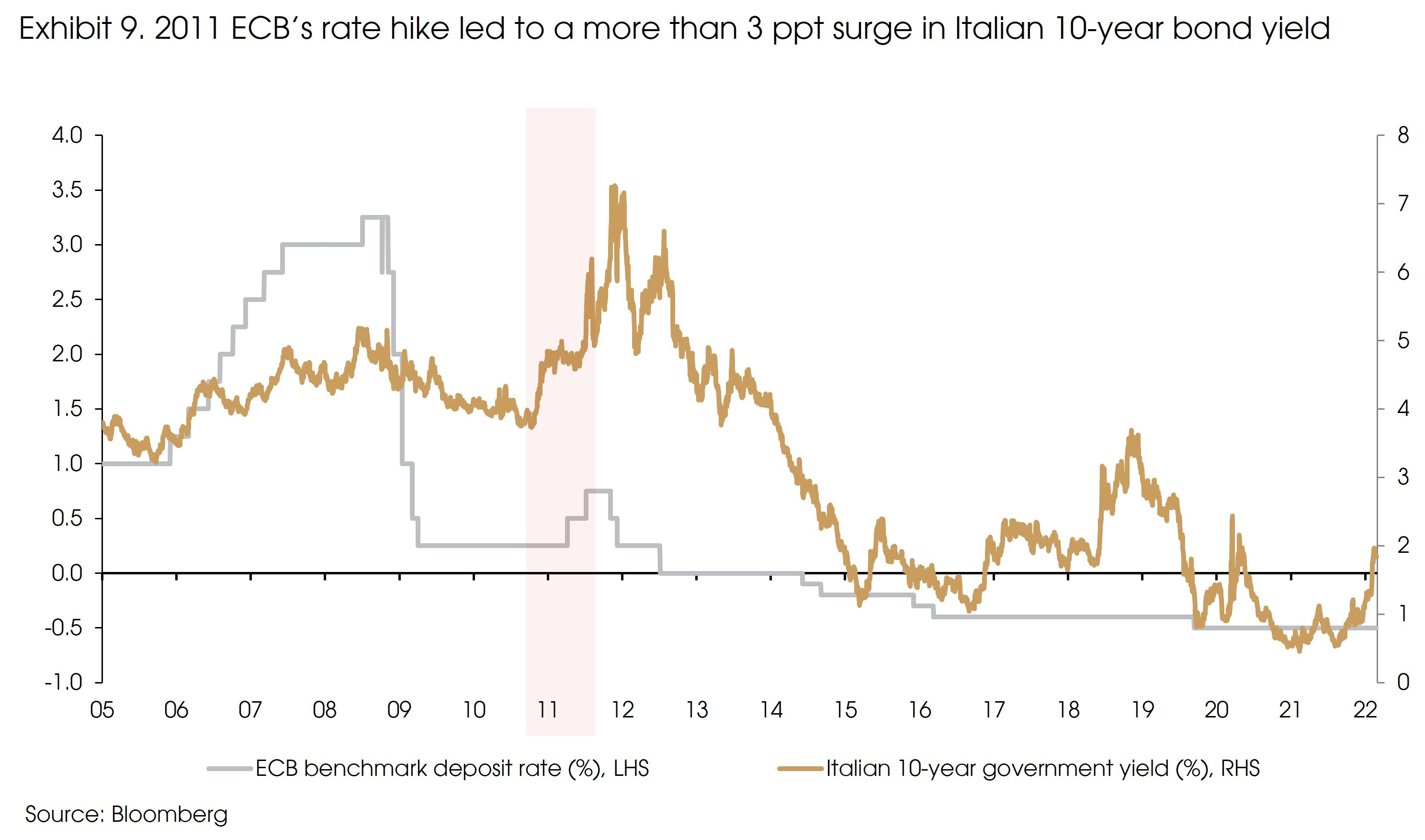

When the central bank raised its policy rate in 2011, it led to rising concerns about debt sustainability in peripheral countries (e.g., Greece and Italy) and a selloff in sovereign bonds, which triggered the European debt crisis.

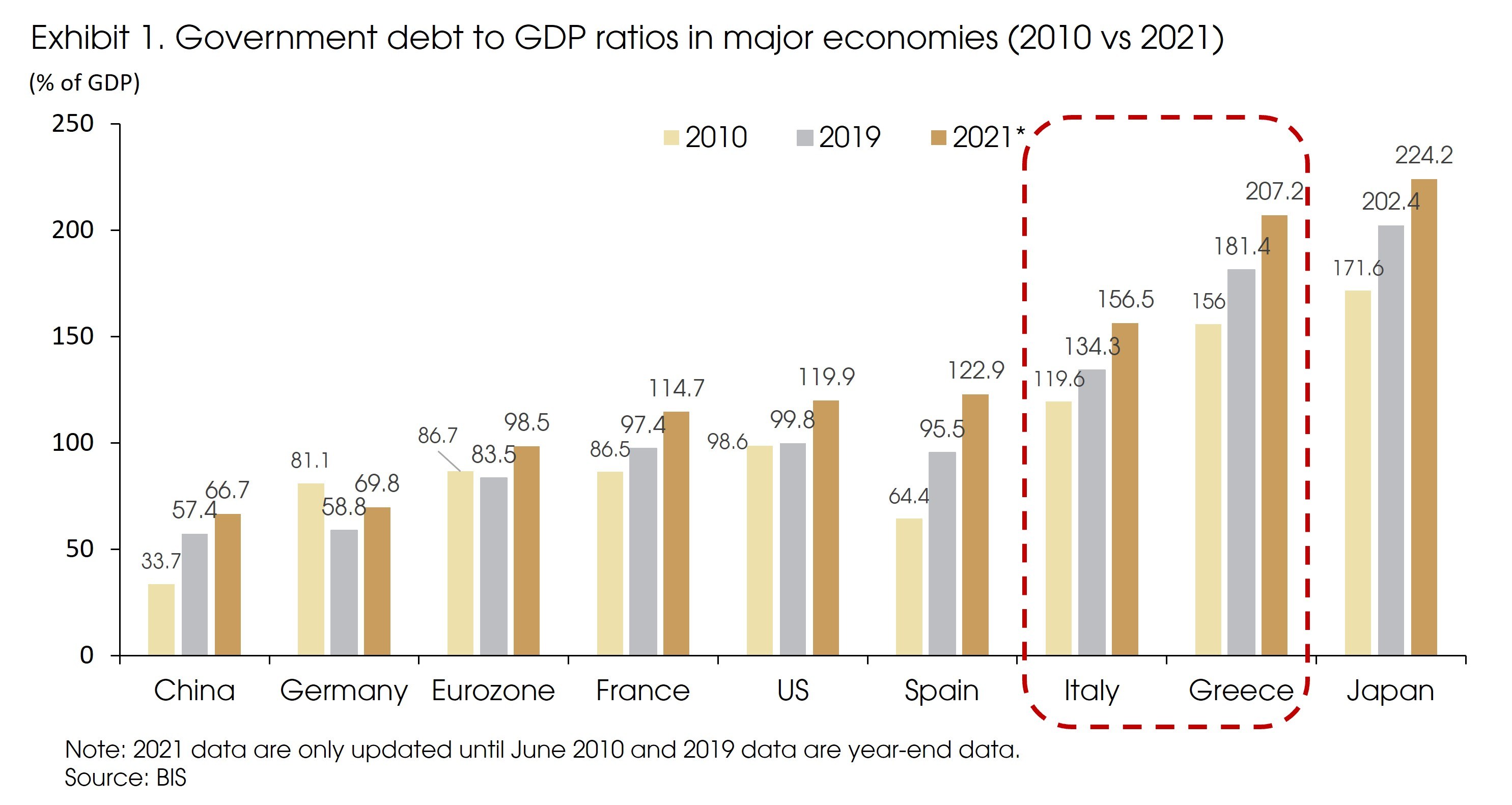

Currently, with even higher government debt to GDP ratios among many European countries, (Exhibit 1), will the monetary tightening cause another crisis? We will try to elaborate our views in this report. Besides, we will also briefly discuss several thoughts on the geopolitical risks caused by the Russia-Ukraine tension.

We see difference behind the currently high debt levels versus the one in 2011

We are not extremely worried about the significantly higher debt levels in Exhibit 1. First, around a half of the increases in debt ratios happened after 2019 due to the impact from the pandemic-induced-recession. Debt to GDP ratios always increase during economic downturns, as GDP growth falls and governments increase spending to support the economy.

The 2020 recession was especially the case: the fall in GDP growth was much deeper than the previous recessions due to the pandemic-related restrictions, and the fiscal support from governments (especially in developed economies) more than doubled compared with the 2008 stimulus packages.

As the pandemic condition improves, the economy recovers, and the fiscal packages expire, the GDP number will rise while the debt number will fall, leading to lower debt ratios. The listed countries’ debt ratios (Exhibit 1) all declined between 1Q and 2Q 2021, by 2-5 percentage points.

Secondly, monetary easing, especially Quantitative Easing, should also reduce the risk of higher debt. For example, the ECB's balance sheet increased from EUR 4.4 trillion in 2019 to EUR 8.6 trillion at the end of 2021. Meanwhile, the Eurozone government bond outstanding only increased by EUR 2.4 trillion, suggesting the central bank is holding at least a large chunk of the newly issued bonds if not all. Going forward, even if the ECB stops such asset purchases as early as this year, it will continue with the reinvestment, maintaining the current holdings of bonds. However, back in 2011, QE was just "invented" by the Fed, while the ECB had not initiated any asset purchases.

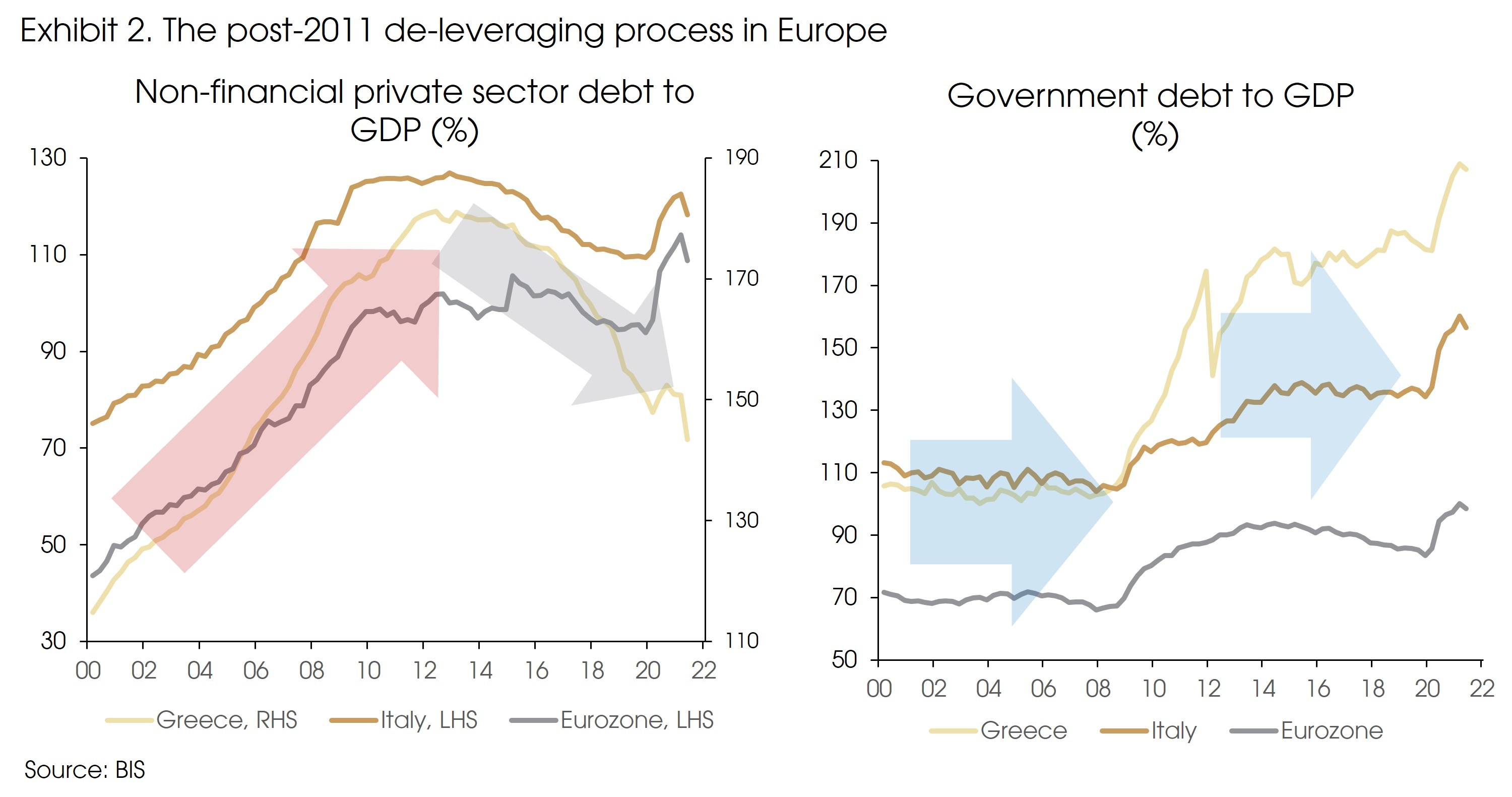

Besides, there are also notable differences from the underlying economy, especially the private sector. During the pre-2011 period, the Eurozone's private sector experienced a dramatic debt accumulation, which lasted for a decade, especially among peripheral countries such as Italy and Greece (Exhibit 2, LHS). For example, from 2000 to 2011, private sector debt to GDP ratio tripled from 36% to 119% in Greece, surged to 127% (almost doubled) in Italy, and more than doubled for the overall Eurozone. Such rising debt ratios suggest unsustainability in the private sector.

In contrast, after 2011, the private sector's deleveraging process has been significant. From 2011 to 2019, the private sector's debt to GDP ratios was notably reduced, given the macroprudential policies adopted after the crisis. Currently, Greece and Italy's private sector debt to GDP ratios remain well below the 2011 level even after the 2020 recession.

On the other hand, government debt ratios were both stable during the non-crisis/non-recession period (Exhibit 2, RHS). Therefore, the unsustainable private sector before 2011 should be, at least, one of the key drivers for the debt crisis.

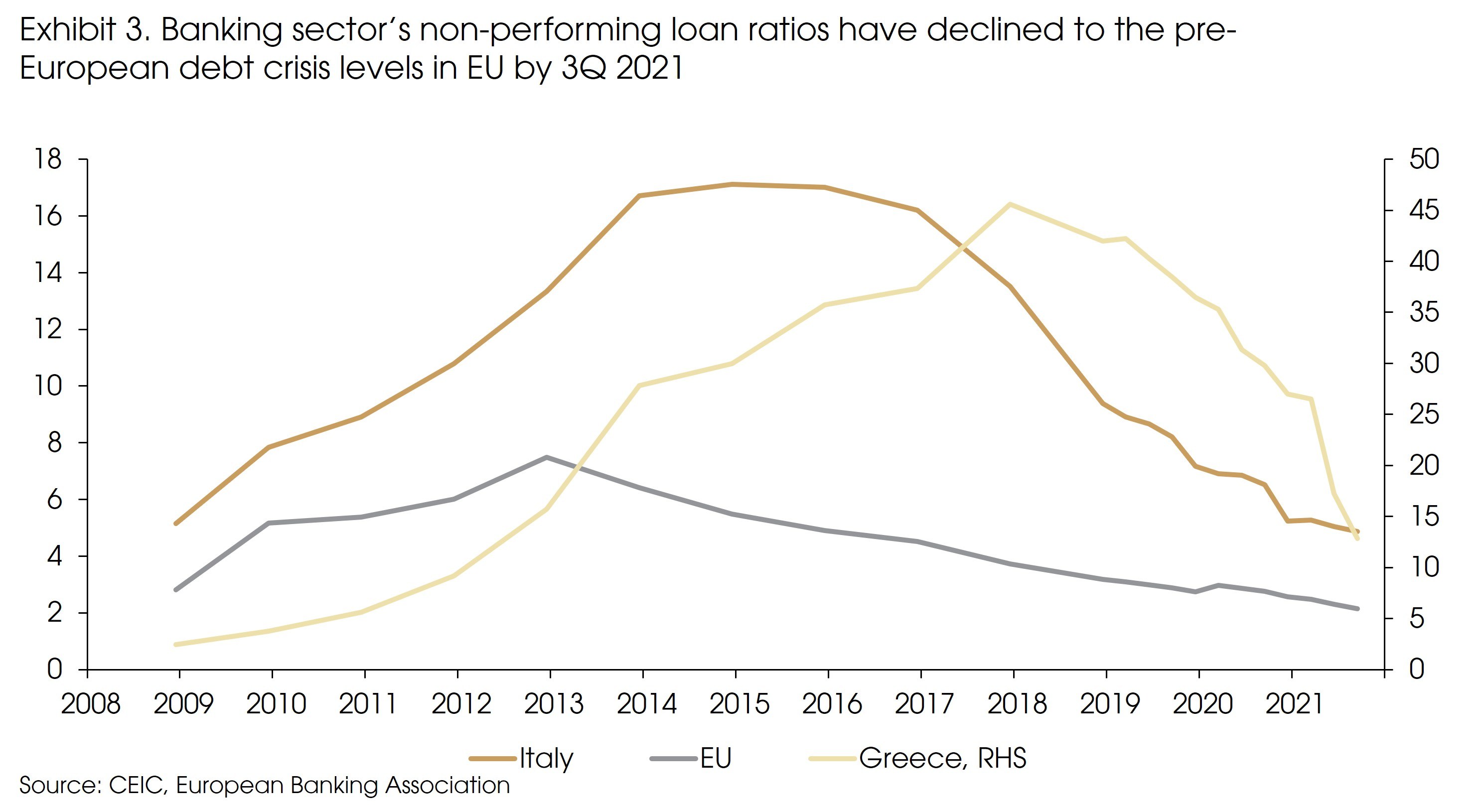

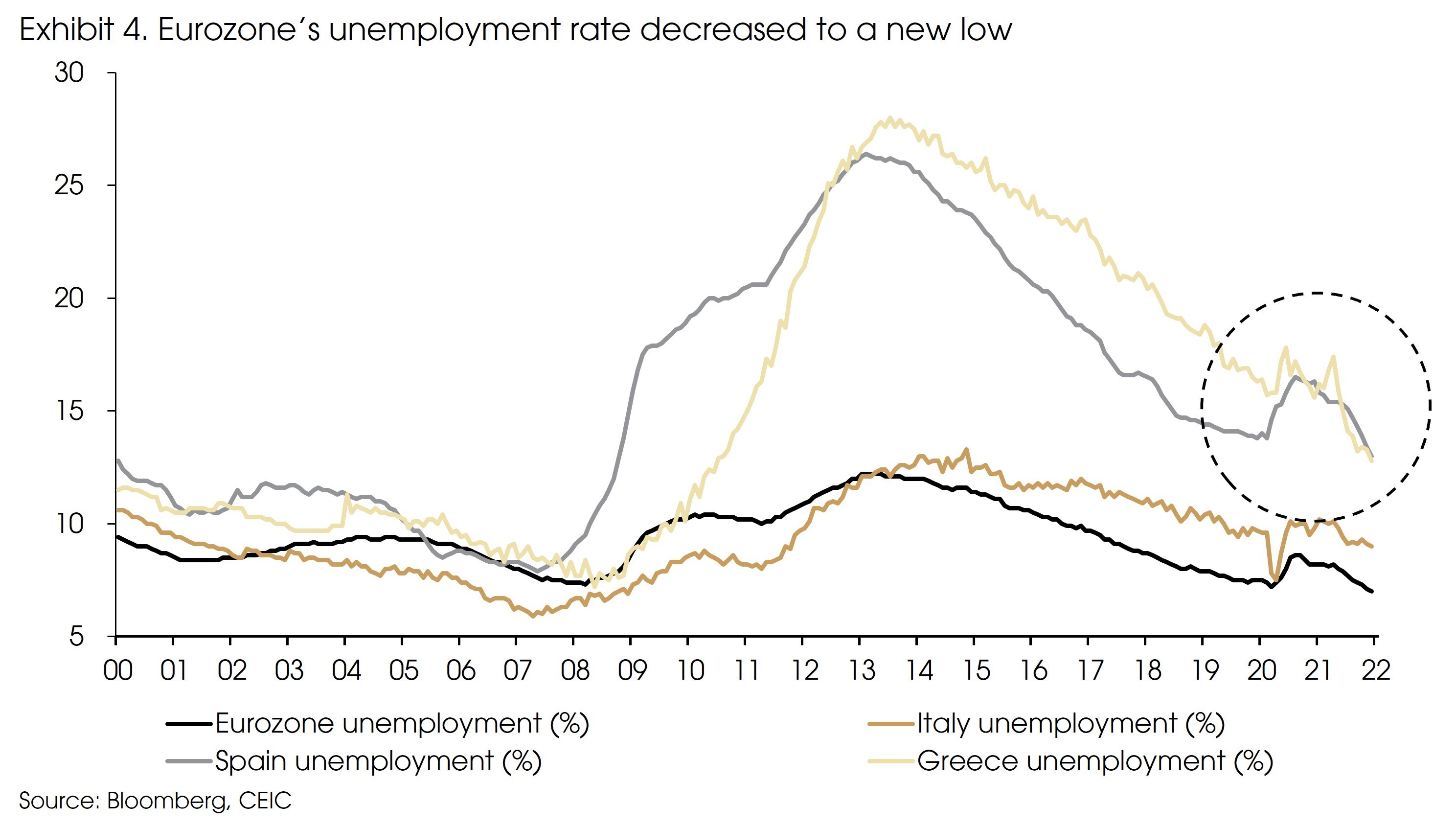

In addition, the rising debt ratio led to solvency risks. (Exhibit 3) The non-performing loan (NPL) ratio rose to 6% for the overall EU and reached around 10% in Greece and Italy in 2011, which both exploded after the outbreak of the crisis, resulting in contagion risks through the banking system and the long-lasting drag in the economy, such as the long-lasting elevated unemployment rate. (Exhibit 4) The unemployment rate kept rising for six years during the previous crisis, from 2008 until 2014.

On the other hand, after the 2020 recession, the more sustainable debt level in the private sector and the government’s policy support have helped to contain NPL ratios among European countries: even for the supposedly more fragile countries (e.g., Italy and Greece), the NPL ratio did not rise at all, while the overall EU achieved a new low of 2.1% at the end of 2021. Similarly, the unemployment rate did not keep rising, but resumed its downward trend quickly at the beginning of last year.

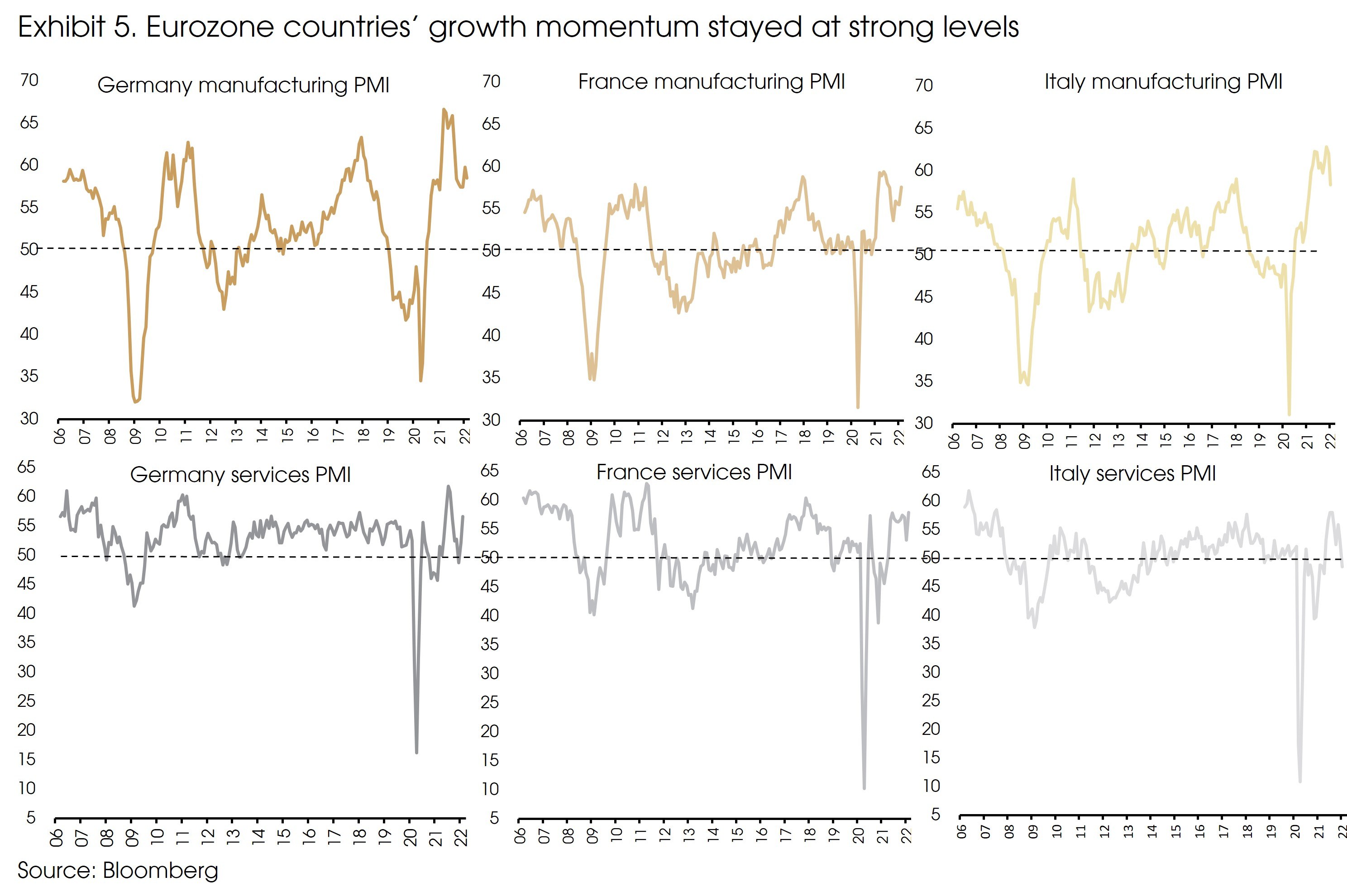

Given the muted scaring effect (i.e., no rising unemployment/debt/NPL) in the private sector, economic momentum rebounded quickly and meaningfully since mid-2020, even with the periodical outbreak of the pandemic, several rounds of re-imposed restrictions by the government, and the supply shortages on specific goods.

Manufacturing PMI surged to near 60 for major economies. Although the service sector in some countries is still struggling due to the remaining pandemic restrictions from specific countries (e.g., China), the overall composite PMI (manufacturing + service) for the region reached 55.8 in February, indicating a 4-5% YoY GDP growth in the Eurozone.

Based on the above data, we see a fundamentally healthier private sector behind the elevated government debt ratios. This more solid private sector and the more supportive government response (more aggressive fiscal and monetary stimulus) both contributed to a brighter growth outlook than the 2011 situation. Do not forget that government revenue highly relies on the tax payment by the private sector.

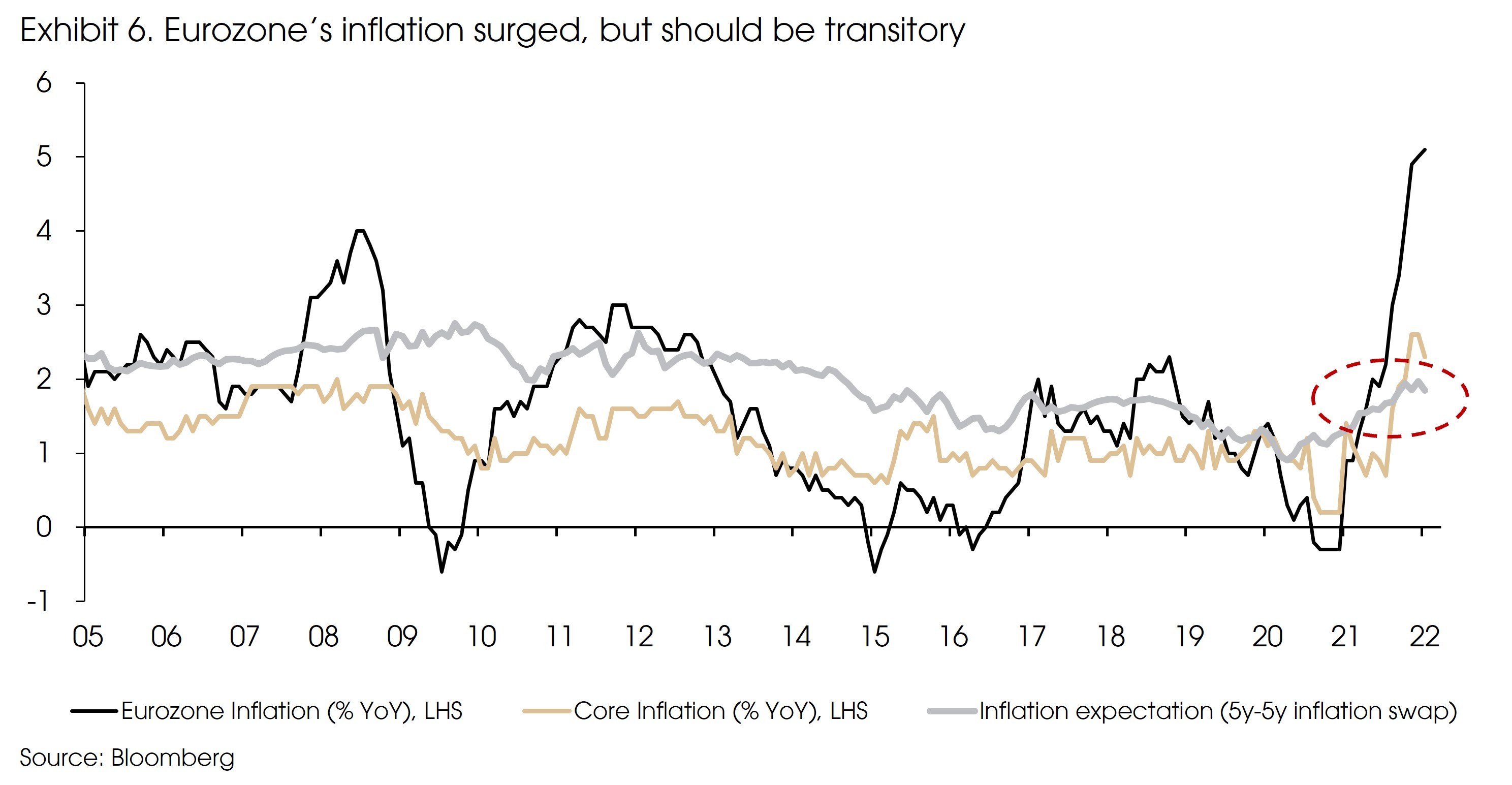

One concern is inflation, which surged to above 5% recently and could drag the economic growth, e.g., by narrowing corporate profit margins and discouraging consumption. However, unlike in the US, the Eurozone’s headline inflation is more heavily affected by energy price inflation, which rocketed to near 28% in February. Meanwhile, the core inflation (price change excluding energy and food) remained at around 2.3%, which should not be a major concern either for the underlying economy or for the ECB (Exhibit 6). Besides, the inflation expectation did not surge, but only returned to the pre-pandemic level, suggesting that the currently strong inflation pressure is still related to the remaining supply chain issues, which should be transitory.

Even if the high inflation will stay longer and drag the economic growth, it is a double-edged sword for debt sustainability: high inflation will reduce the burden for borrowers.

Overall, the fundamentally less fragile private sector and the associated better growth outlook should have allowed the region to withstand external shocks such as monetary tightening (rising interest rates), compared with 2011, limiting the risks of another sovereign debt crisis.

Gauging the debt stability on rising interest rate

The risk of having another debt crisis has significantly reduced in Europe. However, what if the ECB goes ahead to hike the rate? Then, how many rate hikes or how much higher of the interest rate can be considered “safe” for the region?

Debt dynamic models can be very complicated. However, a simple illustration should be enough to address the key factors here:

- Nominal GDP growth

- Average interest rate (total interest payment divided by total debt)

- Government primary budget balance (government revenue minus expenditure excluding interest payment)

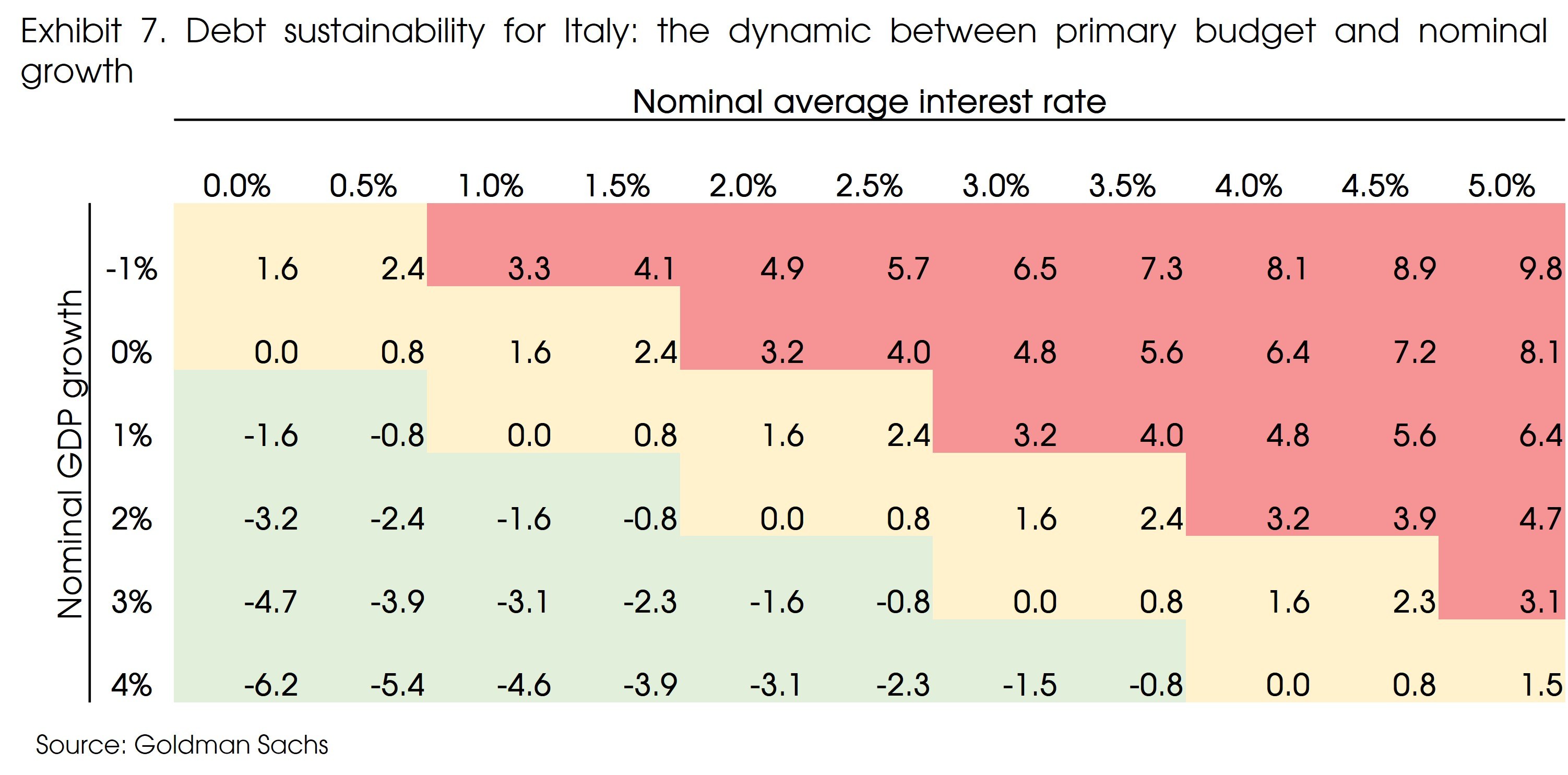

Italy presents a significant portion of the region’s debt outstanding, and it is always the market’s focus when talking about “debt crisis”. According to Goldman Sachs, Exhibit 7 shows the debt sustainability calculation for Italy. It lists the combinations of nominal GDP growth, nominal average interest rate, and primary budget balance to maintain the current 160% debt ratio (i.e., make the current debt ratio sustainable).

Simply put, higher nominal GDP growth and larger primary budget surplus (or narrower primary budget deficit) will sustain a higher interest rate.

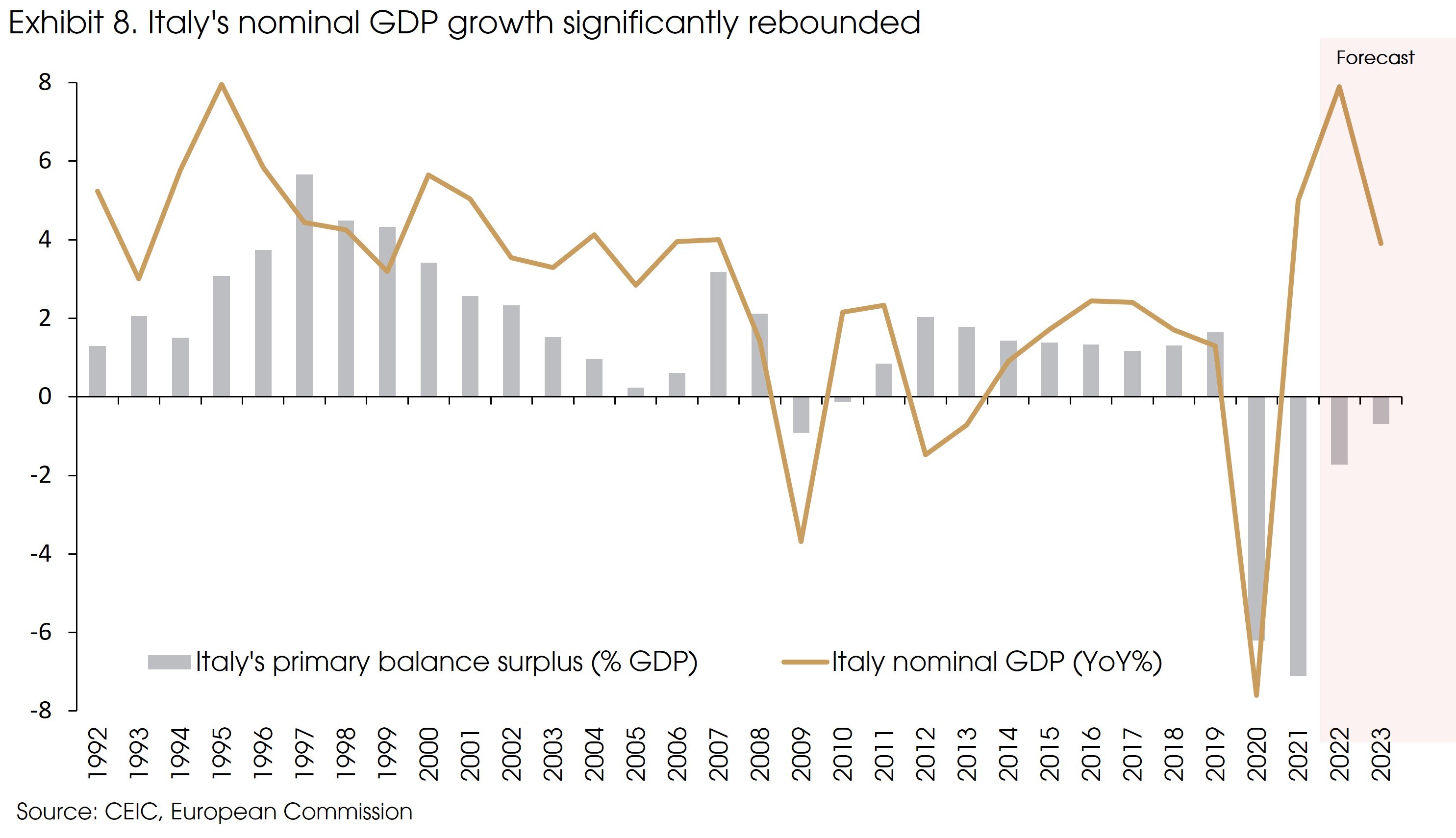

Under the 2011 case, the 2% nominal GDP growth and 2% primary budget surplus were initially able to maintain a stable debt level, given the 4% nominal interest rate (Exhibit 8). However, the 50 bps rate hike by the ECB led to a 3 ppt surge in 10-year government bond yield (Exhibit 9) and 1.5 ppt surge in average bond yield, which broke the balance. In addition, given the high debt ratio and NPL level in the private sector, the rising interest rate triggered a wave of defaults, resulting in a -1% nominal GDP growth in 2012, further exacerbating the unsustainability of debt.

However, the current situation is less fragile, even with a large negative primary budget of -7% (like in 2021). (Exhibit 8) Italy's nominal GDP growth strongly rebounded to 5% in 2021 and is expected to stay high at 8% this year (higher inflation also contributed to this high number). With such a high nominal GDP, Italy's debt can sustain a 2.5% interest rate (vs. the current 1.8%) even if the primary budget deficit remains -7%.

The question is, what will happen after the significant rebound from the recession. Nominal GDP should return to the previous 1.7%. However, the pan-EU recovery fund is expected to add 0.2-0.4 ppt to the region’s GDP growth, with the lift more pronounced on peripheral countries. Moreover, the recovery fund is also a financing scheme that provides lower-interest European loans to peripheral countries for projects related to structural reform, green energy, and digital infrastructure. According to Goldman Sachs, Italy will pay a substantially reduced borrowing yield on European loans (more than 130 bps), contributing to keeping interest payments under control.

Therefore, it is reasonable to expect the Italian economy to maintain a 2% nominal growth (slightly higher than the pre-pandemic one, given the recovery fund’s boost and the slightly higher inflation pressure). Its primary budget should also return to the pre-pandemic level of around 1%. Therefore, a 2.5%-3% interest rate (higher than the 2.5% level in 2019) should not cause any risks regarding the country’s debt sustainability (seen from Exhibit 7). In other words, Italy should be able to comfortably withstand a 10-bps hike from the ECB, i.e., from the current level of -0.5% to -0.4%, the 2019 level.

However, a potential risk is that if the EU requires member countries to reinstate the debt and budget rules in the Stability Pact (i.e., countries that violate the 60% public debt upper limit need to keep +3% budget balance to reduce the debt ratio). Declining government debt would require either higher nominal GDP or a more austere government. Both can be challenging for Italy.

What about the Russia-Ukraine tension?

The Russia-Ukraine tension poses another risk to the Eurozone economy, leading to negative GDP surprises through three aspects: 1) tightened financial condition, 2) trade exposure (exports), 3) rising energy price (oil/gas).

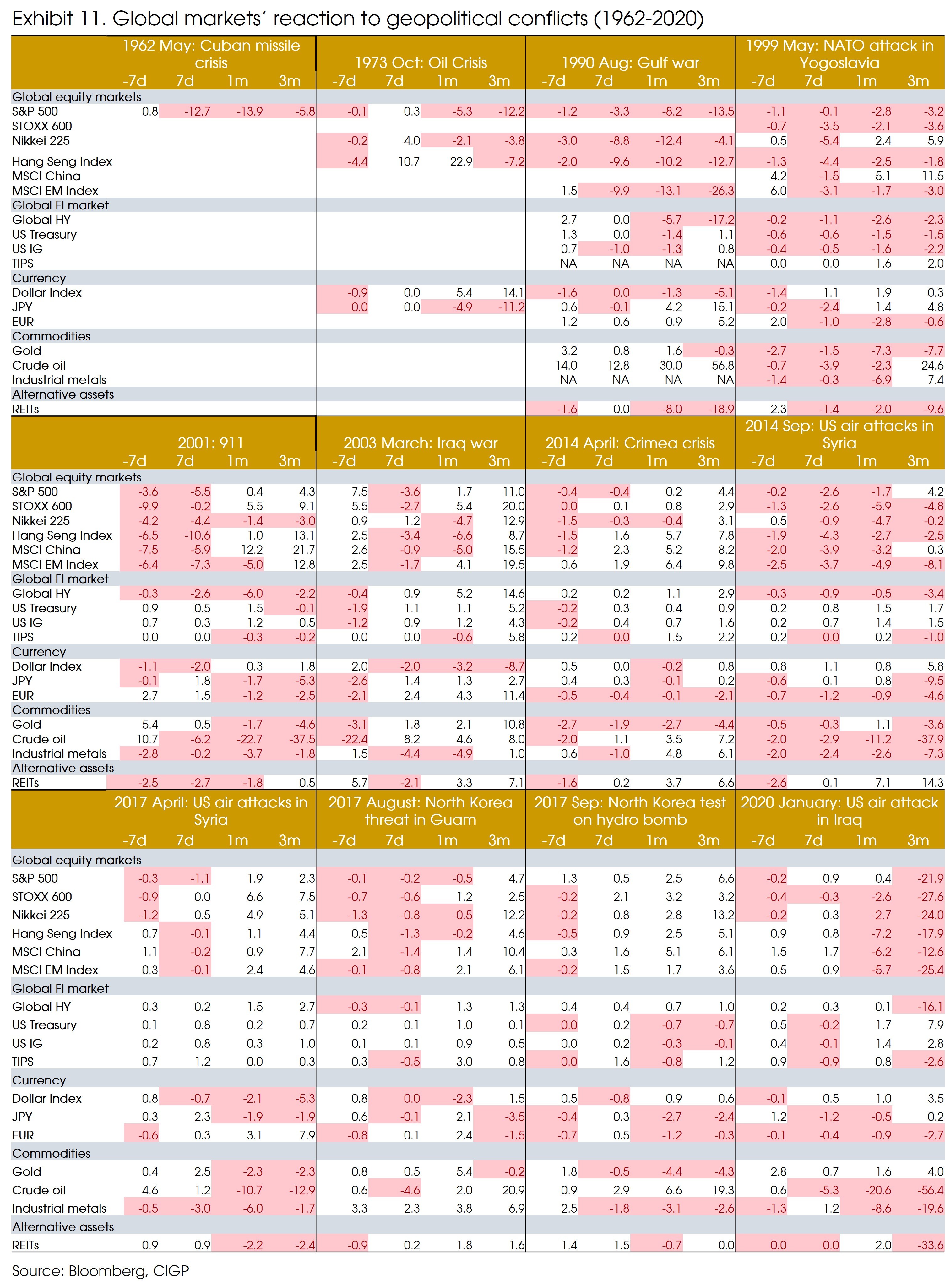

As seen from the previous geopolitical tension episodes (Exhibit 11), financial conditions usually did not tighten significantly in the Eurozone, as cross-border banking exposure to Russia and Ukraine is lower than 2% (Goldman Sachs).

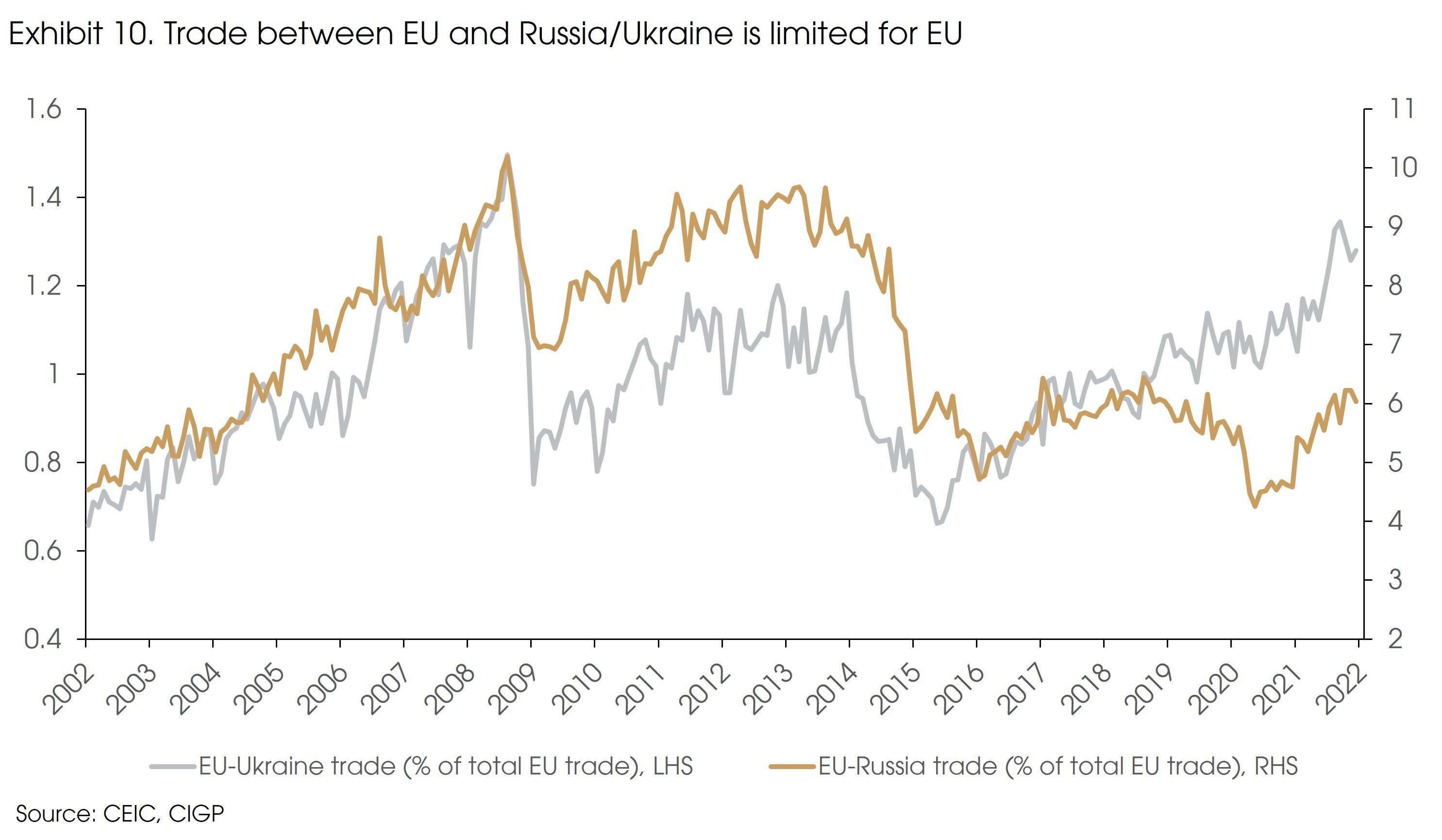

Neither Russia nor Ukraine are important trading partners for the Eurozone (Exhibit 10). However, Russia is the region's most important supplier of energy goods, especially natural gas, accounting for more than 30% of natural gas supply, which leads to the third aspect.

Rising tensions could affect the European economy via energy markets, especially natural gas, which is the biggest risk faced by Europe. Any prolonged sanctions on Russia's Nord Stream 2 pipeline exacerbate the already very tight European gas markets, leading to another energy crunch. Further increases in gas prices could imply an additional drag on growth by raising households' energy costs and lowering consumer spending.

However, the price impact should remain mild, seen from the 4Q 2021 case, when energy prices surged, while the economy still recorded 4.6% YoY GDP growth, as price surges were cushioned by either long-term electricity contracts or government support schemes.

Instead, the potential energy cuts and production disruptions pose a more significant risk to growth. According to Goldman Sachs, a disruption of Russia's gas supply through Ukraine (around 4% of European consumption) will lead to a 1% production decline in Germany and France, and 3% in Italy. These magnitudes are significantly larger than the drag caused by higher gas prices, although the hit to production should be temporary and will bounce back once the regular supply is restored.

This also explains why Germany opposed the SWIFT sanction on Russia. Seen from the 2012 SWIFT sanction on Iran, it led to a 50% decline in Iran's oil exports as the ban significantly increased the cost/difficulty of cross-border payment with Iran, seriously affecting international trade.

Based on the currently revealed sanctions by the western countries, the growth risks should be manageable for the Eurozone, unless the tension further escalates and leads to sharply tightened financial conditions, or energy cuts across Europe.

Geopolitical tensions are much less predictable than other events on the asset prices. They always lead to risk-off sentiment in the market or even over-reacting in the short-term, suggesting rebound opportunities.

However, now, it is too early to think that the global market is out of the woods, even if in most cases, the impact from geopolitical tensions only last several months and with mild corrections (less than 10%, Exhibit 11), unless followed by economic recessions.

Another major risk is still the policy shifts from central banks (especially the Fed and the ECB), which could still deliver surprises in the coming months. It is reasonable to turn more defensive, by adding protection or raising/keeping cash.

Sources: BIS, Bloomberg, CEIC, European Banking Association, European Commission, Goldman Sachs, CIGP